We use cookies to enhance your experience. Basic cookies are essential for the proper working of this website. For example, they save your language preferences. They also help us gather anonymous information about the use of our site. More information in our Cookie Policy.

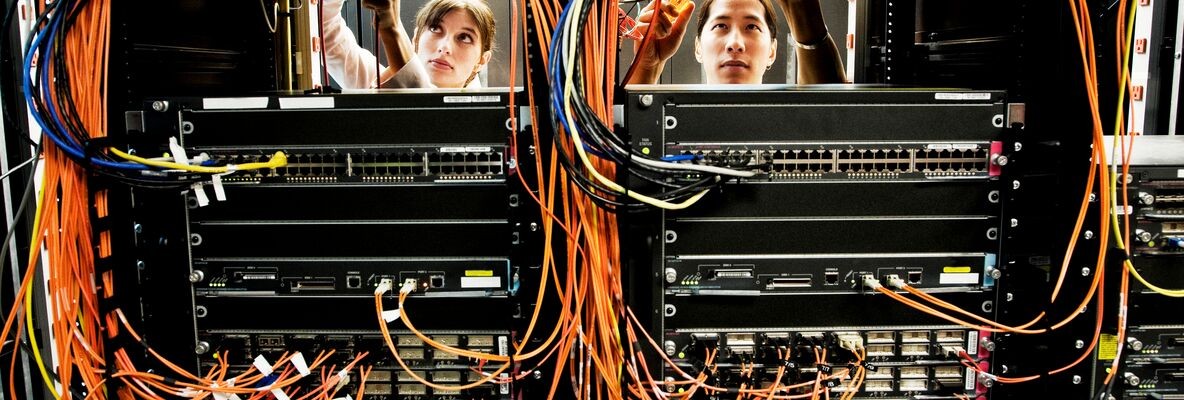

Big Data at the service of society

According to IBM, 90% of the world’s data has been created in the past two years. Extracting value from this raw material hinges on the use of emergent practices and technologies commonly known as “Big Data”. In use in all areas, Big Data has gained a prominent place within society. But how does it work? Although often seen as overly intrusive, statistical analyses can also be very useful in everyday life. Here is a quick overview of the different possibilities.

Towards the industrial revolution of the twenty-first century?

Big Data, as the term suggests, consists of a very large volume of data that no classic data-management tool can handle rapidly and efficiently. This Big Data involves information we use every day: the messages we send, GPS data, videos we publish on the internet, web browsing, transactions, and much, much more. In 1992, the volume of data produced daily was 100 gigabytes, as opposed to 2.5 trillion gigabytes today. Big Data thus refers to innovative storage solutions combined with sophisticated algorithms permitting the analysis of this digital data.

The arrival of Big Data is being presented by some as a new industrial revolution, equivalent to the discovery of the steam engine, while others speak of a third industrial revolution: an information revolution.

The internet, a pioneering sector

Have you ever asked yourself how search engines optimise the ranking of results? Or how the giant online corporations automatically manage to display offers for items that perfectly match your last purchase? The Web is one of the sectors that collects and analyses the most data with a view to improving the customer’s experience. All this data is then processed and assembled by machine-learning, statistical algorithms, which highlight the needs of the customer. The principle is a simple one: starting from several purchasers of a single product, it is possible to put together a profile of the typical customer for the product in question, and thus offer each consumer the ideal product appropriate to their needs and situation.

Watch out for blunders, however: a well-known American supermarket chain managed to detect that a customer was pregnant thanks to her purchases. As a result, they sent targeted commercial offers to this customer… which were received by her father. This is how this particular father learned that his 16-year-old daughter was pregnant.

Other unexpected areas of use

“BabbyCam” is a monitor that allows the supervision of babies in their cots. Based on deep learning, the device recognises the baby’s positions and emotions and thus permits the detection of an incorrect sleeping position or a cushion that might hinder the baby’s breathing, and even spots if they are crying. The device then automatically sends text alerts in order to warn the receiver of any such problems.

Also used in politics, Big Data helped Obama during the 2008 presidential elections! The Democratic Party benefited from a gigantic database, which brought together information from the website and from the candidate’s meetings. Thanks to machine-learning algorithms, the detailed analysis of this data spotlighted specific sociological and demographic information about voters, and thus improved the targeting of adverts and phone calls.

Big Data’s role in the field of banking

- The use of data to improve the customer experience

Banks are increasingly obliged to call on Big Data technologies to get to know their customers better and create closer, privileged links with them. By familiarising itself with each customer, the bank can, as a result, personalise its services and respond adequately to their needs.

- A new tool against bank fraud

Whether the attempt was successful or not, most of us have been the target of bank fraud: theft of a bank card, a fraudulent online purchase, or a phishing email. Machine-learning algorithms allow unusual transactions to be detected. In order to do this, banks can cross-reference a request for authorisation of a payment by card or transfer with the transaction history of the same client, which permits the risk level of the transaction to be evaluated.

A genuine decision-making tool, Big Data must be seen as a helpful instrument that will become ever more present in everyday life. And this is just the beginning.

12/21

-

Key points to consider for a successful transfer

The transfer of wealth is often a sensitive subject, associated with strong emotions: family, professional and other. And yet, properly preparing the transfer of one's wealth is a crucial step in ensuring its sustainability and growth, and guaranteeing a fair distribution among potential heirs...

-

Big Data at the service of society

In use in all areas, Big Data has gained a prominent place within society. But how does it work?

-

How to start a business in Luxembourg as a startup?

As Luxembourg want to become a startup nation, more and more newcomers are poised to create their own businesses

-

How to invest in Luxembourg investment funds?

Luxembourg is the leading investment fund centre in Europe. Investment funds in the Grand-Duchy cover all key categories, currencies, regions and sectors. They can be an opportunity to make your financial resources grow faster in a time when interest rates on saving accounts are very low. But how do they work?