We use cookies to enhance your experience. Basic cookies are essential for the proper working of this website. For example, they save your language preferences. They also help us gather anonymous information about the use of our site. More information in our Cookie Policy.

Are you sure that you benefit from all the existing opportunities to reduce your taxes as much as possible? There are many fiscal products on the market.

Benefit from a tax advantages of up to €1334 (from 18 to 40 inclusive) or €672 (41 and over) per member of the household, plus :

ING Plan Pension offers the possibility of taking advantage of the maximum tax deductible limit of €3200/year. These formulas allow you to :

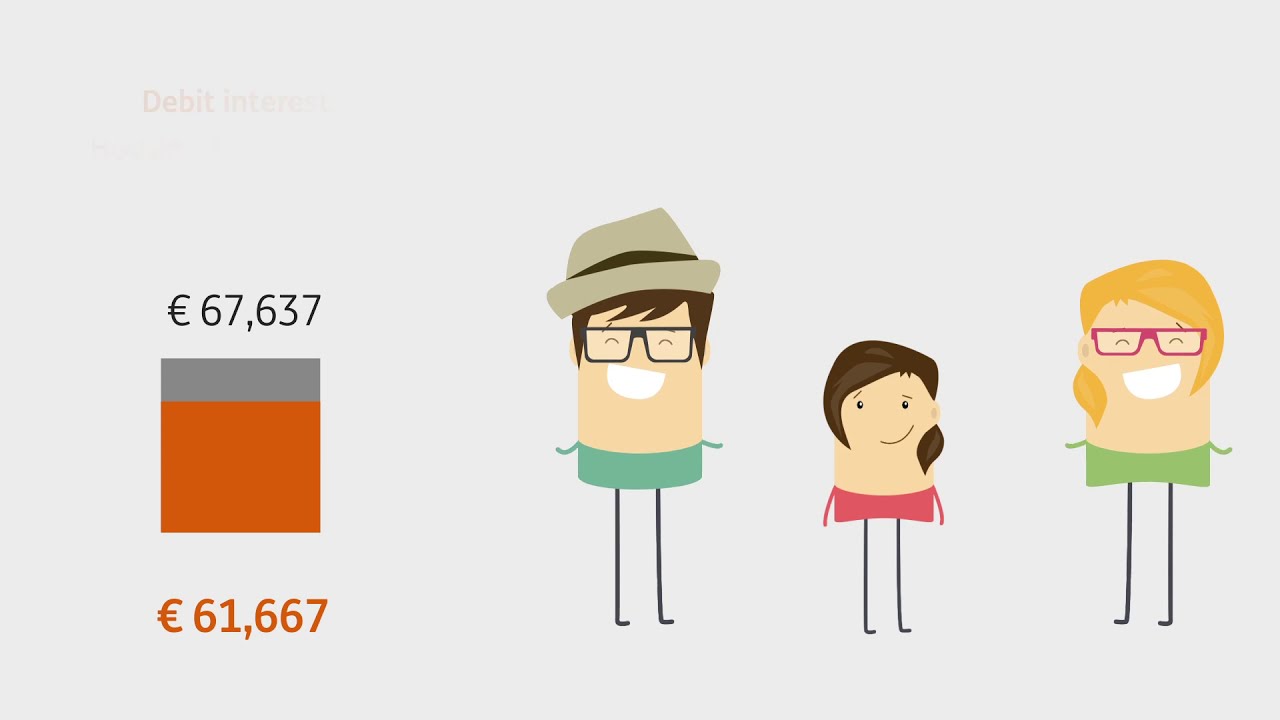

Provided you are a Luxembourg tax payer, or the equivalent, you can deduct from your taxable income up to EUR 672 per household member in interest on your loan and insurance premiums.

An extraordinary increase is provided when you subscribe to a balance insurance remaining due (as part of a housing loan).

Are you trying to increase your buying power by reducing your taxes? The Luxembourg tax system allows you to do this via special deductible expenses.

-

Be your own architect: see your savings grow!

Yes, sometimes we are our own biggest enemies when it comes to sticking to our personal budgets. For every commitment we make to saving money, there is always a temptation to spend just a little on ourselves. What happens when the silly concept of a personal budget gets in the way of the desire to shop? Let's see how you can respect your budget.

-

Tax deductible pension savings plans

Everybody knows they should do something for their pension, but more often than not we seem to think that our pension is still a long way away and that providing for it can wait another day. In this article I will explain you a bit more about pension savings plans.

-

How to optimise your tax declaration?

Every year, it is the same old story: we have to fill in our tax declaration. For many of you, this annual exercise is like a chore. It is a pity because a tax declaration, correctly optimised, can save you money by reducing your taxes.

How can we help?

My ING - Your online banking solution

Log in and do your transactions when and where you want.

- My ING, the online banking solution for individuals

- My ING Pro, the online banking solution for business

My Team - Your Contact Center

For support on online banking, information on our products and our services or any other question, your Contact Center is available from Monday to Friday, 08.30 am to 06.00 pm.

My Experts - Your network of branches

Our advisors are at your disposal to help you.