We use cookies to enhance your experience. Basic cookies are essential for the proper working of this website. For example, they save your language preferences. They also help us gather anonymous information about the use of our site. More information in our Cookie Policy.

Find all our articles related to new payments methods, expenses and budgets.

-

10 ways to make your Wi-fi more secure

By now, most of us know that public hotspots aren’t always safe to use. Yet, internet security can be an issue even when using your home Wi-fi. Here are a number of ways to improve network security at home.

-

5 tips to save money on your skiing trip

Winter sports holidays are quite expensive. Thus, I wanted to share some savvy tips to enjoy them as much as possible without worrying about money with you!

-

5 websites to personalise your gifts

Are you looking for a truly original, personal gift? There are more and more websites that enable you to personalise clothing, accessories, furniture, and gadgets in just a few clicks. Here are a few sites offering the most interesting customisation options.

-

6 facts about inflation you should know

Inflation is an increase in the general level of prices of goods and services over a period of time: the inflation rate is the annualized percentage change in the general price index (consumer price index)

-

7 tips to cope with the sales without breaking the bank

You don’t want to bankrupt yourself? Not easy to do during the sales period! Here are 7 tips for a successful sales period!

-

8 tips on how to create a budget

September, the perfect time to adjust my budget for the end of the year. So easy to create, so difficult to stick to it… I can’t get rid of this sentence when it comes to budgets! Are you the kind of person that creates a nice, well-organized and empty spreadsheet? Empty meaning that you never fill it? Or are you exactly the opposite: a real budget freak? Do you even have a budget?

-

All that glitters is not gold! Don’t be fooled by the name of your credit card

Bronze, silver, gold, platinum. They started off as plain coins, then as anniversaries; at some stage they became the prizes for competitions, and the frequent flyer status you have. And now they are different types of credit cards.

-

All you need to know about BIC and IBAN

IBAN (International Bank Account Number) is an international standard that identifies a determined account in a financial institution anywhere in the European Union. This unique number may contain 14 to 34 alphanumeric characters and has a fixed length for each country.

-

Are pets too expensive?

You absolutely need a cat or a dog in your life but you don’t know how much a pet will cost you? According to a study released in 2012, our French neighbours – who incidentally own the most pets out of all European nations – spend a yearly average of € 600 on their cats and € 800 on their dogs. Statistical data on pet ownership in Luxembourg are difficult to obtain. According to the only available figures, we spend € 937,8 a year but this number includes not only money spent on pets but also expenses linked to flowers and gardens!

-

Are you ready for the Data Protection Day?

January 28th will mark the 10th anniversary of the Data Protection Day, an initiative launched by the Committee of Ministers of the Council of Europe to promote cyber-security. Here are some tips to protect yourself online…

-

As a self-employed person, do I need an accountant?

Your sole proprietorship doesn’t know the meaning of crisis? Wonderful! In this case, does your small business need an accountant? Legally no but in practice, the answer is subtler than you think.

-

Banknotes are also fashion victims

Well, that’s not entirely true. The new ten euro banknote circulates since September 23 2014. It is the second banknote to change its looks since the introduction of the euro banknotes in 2002. And it seems that the five euro and ten euro notes were only the first ones to change – the European Central Bank (ECB) has a program of several years to upgrade all banknotes in ascending order.

-

Be good at money this Christmas – starting now!

We’re rapidly approaching the holiday season: it’s time to start planning your shopping (grocery and otherwise) to avoid excesses in last minute spending. As you know, the price of many products goes up as we gear up for “the most wonderful time of the year”, so get ahead of the curve and be good at money this Christmas. Here’s how:

-

Can banks face turbulent times?

After the last financial crisis, many of us want to know how resilient the banking sector really is. Last week, the results of the latest European stress tests were announced.

-

Can we change banks easily ?

Prepare to take that leap ! One of the most wildly spread urban myths is that it’s a hassle to change banks. Well, it isn’t. At least not in Luxembourg, where it’s both easy and free! It actually happens in 3 easy steps.

-

Does your credit card have travel insurance?

When it comes to travel, it is understandable that you are more focused on choosing the best destination and booking the best hotels, but insurance is a key part of making sure that your dream trip does not turn into a nightmare.

-

Do I have to subscribe to a debt balance insurance?

But, first of all, let’s remind what a debt balance insurance is. This form of accidental death insurance covers the outstanding balance of the loan in the event of your death. The insurance is limited to the duration of the loan and the amount paid by the insurer is the outstanding principal balance of the loan on the date of your death. The beneficiaries are the persons designated in the policy (the spouse or the children for example) or the lending institution. Against an additional premium, some companies extend the cover to disability and loss of income.

-

Don’t run out of money for running!

Discussions in specialized running forums seem to leave no doubt: you have to spend a fortune to practice this sport. Every day there are new items of apparel and gadgets in the stores, and the more you get into the subject, the more things you seem to need. But don’t despair; even if you belong to those who like to be fully and appropriately equipped, it’s also possible without deep pockets.

-

Entrepreneurs and the law on marital assets

It may be decidedly unromantic to consider the possibility of a split on the cusp of getting married, but for entrepreneurs it’s a question that may need some serious thought.

-

Evaluating your borrowing capacity

Before taking out a loan - especially a property or home loan - it is important to accurately determine the amount you are able to repay each month to avoid debt building up. In other words, to find out your borrowing capacity.

-

From dream to reality: how to carry out your projects?

Everyone has projects but few of us are able to achieve them. There may be several reasons for this: no time, no money or simply circumstances of life. Should we abandon our projects and only dream? Not necessarily. Here are some tips that may help you to make your dreams a reality.

-

Holidays: Have you thought about your budget?

It’s an important point but difficult to estimate in advance, what with transport, accommodation and food, etc. For an assessment of your holiday budget that’s as accurate as possible, follow the guide!

-

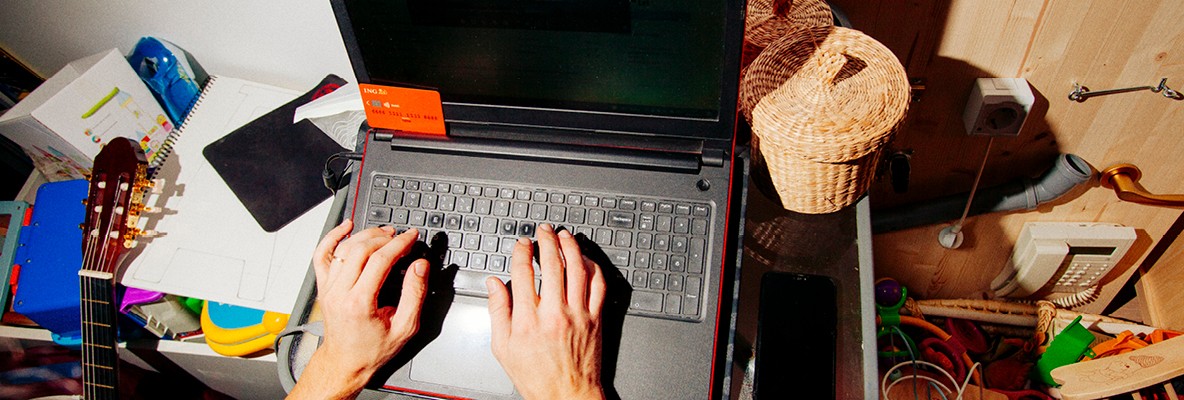

How can I limit the risk of fraud on my bank card?

The bank card is such a part of our daily lives that we all tend to forget that it can be the victim of all kinds of fraud... and cause us a lot of trouble! Here are some tips to limit the risks online but also at retailers.

-

How do exchange rates work

Currency floating exchange rates change constantly based on a multitude of factors. Like equities in the stock market, floating rates are determined by the forces of supply and demand in the foreign exchange market (Forex).

-

How much does divorce or separation cost?

Divorce or separation is always difficult to live. Leaving your long-term partner is emotionally painful but can also impact your financial future. Here are the top five ways to financially prepare for your divorce or your separation.

-

How much does your money cost?

Nope, we’re not talking about the cost of the paper or the ink used to print money. Though that might make an interesting article too. Do you know how much your money costs you? It’s a strange concept. It seems obvious that a €5 note costs and is worth €5. But if you go to the bank and “buy” €5, the price will be 5€ plus interest. A-ha! That’s how much money costs.

-

How our nationality and our culture may influence our spending habits

In these times of globalization, our consumer behaviours are becoming more and more standardized and our cultural differences more and more eroded. We consume more or less the same things, and buy more or less the same goods. This is particularly the case in the European Union where cultures and borders are becoming increasingly permeable and interlinked.

-

How our spendings habits reflects our social origins?

The way we spend our money tells a lot about our social origins and education. And sometimes independently from our income. Even if our revenues can increase or decrease, our expense habits don’t change or a little. Beyond a common foundation to the whole population and taking into account that many counterexamples exist, the way we consume depends on our social origins.

-

How to become your own boss in Luxembourg?

You want to create your own company and become your own boss? You have deeply analysed the market and the competition and discovered key needs to whom you can bring an added value?

-

How to find the right bank for you in Luxembourg?

If you have just arrived in Luxembourg or if you intend to come into the country in the near future, one of your first steps will be the opening of a bank account. But which bank to choose? Is it possible to open a bank account before your arrival in Luxembourg?

-

How to manage your finances when travelling abroad

Caps on your spending, bank cards incompatible with local devices, theft/loss, etc. There are many situations that can disrupt your business trips and/or holidays abroad. Don’t panic – MyMoney has all the advice you need!

-

How to plan for retirement in Luxembourg?

When making a significant financial investment (property, car, etc.) people often ask themselves this question: will I have paid back my loan by the time I retire? A question which is often followed by: and when in fact will I be able to take my statutory retirement under the arrangements in Luxembourg?

-

How to prepare for a sabbatical year?

Do you want go back to school? Do you wish to go around the world before starting your professional career? Do you feel the need to live in another way to give a new direction to your life? Whatever your motivations, whether you are a student, a boss, an employee or a self-employed, there is no age to take a sabbatical year. But you have to prepare for it financially if you don’t want that this sabbatical time seriously threatens your balance budget.

-

How to save for Valentine’s day without breaking your bank account

Love is in the air …Valentine’s day is approaching. And you want to surprise your loved one, but you are on a tight budget and now you have absolutely no idea what you should do? It is fine. Me neither That is why I gathered some tips just for you to save your Valentine’s day without breaking your bank account … As you may know, money can’t buy love, but play it smart and you will end up with a happy Valentine as well as a happy bank account.

-

How to spot a fake banknote?

Did you know that the number of fake euro banknotes has leapt by 37% over one year? In 2015, 454,000 fake banknotes were withdrawn from circulation, against 331,000 during the same period in 2014. The most desirable were €20 and €50 banknotes.

-

Inflation: Will you be a winner or a loser?

Inflation has been a top of the agenda discussion item for a while now, but it is mostly treated from a macroeconomic perspective. But inflation basically hurts people’s purchasing power and there can be huge differences with regards to its impact on individuals. Who would be the winners and losers in case of an inflation kickoff? What is the impact of inflation on different people? Let’s consider the impact of an increase of the inflation rate in some typical life situations in Luxembourg

-

In the footsteps of Erasmus – opportunities for studying abroad

By the time they are 18, many young adults are itching to experience new adventures. Studying abroad is a structured way to discover a new country, improve language skills and achieve internationally-recognised qualifications. Employers may also look favourably on students who have had the courage to explore or whose experience may be valuable to an international business.

-

Licensed to drive: motoring legally in Luxembourg

It may be possible to explore Luxembourg City with a leisurely stroll, but heading further afield requires a car – and a valid driving licence. What do newcomers from abroad need to know in order to drive legally in the grand duchy? A licence issued by another EU or European Economic Area member state will still be valid in Luxembourg. The grand duchy introduced the standard European driving licence in January 2013.

-

Living together, is it less expensive?

Yes and… no. On one side, sharing costs (rent, food, car, etc.) enables you to make significant savings. Moreover, if the couple registers a civil partnership to their local commune, taxation is more advantageous than separate taxation, even without children. On the other side, living together is not necessarily Scrooge’s paradise. Unexpected expenses can occur like, for instance, the fact that one partner doesn’t want to impose limits to the lifestyle of the other or hides debt for fear of compromising the relationship.

-

Move: the useful checklist

This is the D day: you’re moving! All the paperwork is done and you have the keys to your new home. It is time to move in!Is everything ready? The secret to ensuring your removal goes smoothly is proper organisation. Packing your belongings in good time is essential. It allows you to sort through them and throw away what you no longer need. If you do not want to throw away your unwanted items, you can give them away or sell them on second-hand sites or at a flea market

-

Nine savings tips for single people

The figures prove it. As in many European countries, increasing numbers of people in Luxembourg live alone. The last census, conduced in 2011, indicated that 75% of Luxembourg residents aged between 25 and 29 were single, as was also the case in Germany, Belgium, Spain, France and the Netherlands.

-

Online payment in Luxembourg: always safer and more convenient

With the COVID-19 crisis and the health rules it imposes, payment for online purchases has gained new momentum, thanks in particular to 3D Secure technology. But what is 3D Secure and how does it work in Luxembourg?

-

Paint your doors and get some grapes: the countdown to the new year has begun!

As the clock strikes midnight on 31 December, people from around the world break out in cheers and celebration, wishing each other good luck for the new year. Yet, as nations and regions differ in culture and history, so do their end-of-year traditions. Here are some examples of how countries ring in the new year

-

Parental leave: your rights are changing

The birth of a child is one of the most important moments in your life, and maximising the work-life balance is essential when you're starting a family. Parenting is about to get much easier in Luxembourg, where the government has just expanded the range of options for parental leave. Beginning on 1 December, maternity and paternity leave will be more flexible and better paid under the new parental leave regime. Want to know more but it sounds like astrophysics? Don't worry, here's a simple break down of the primary changes:

-

Purchase warranties: the « little plus » of your credit card

It's no secret that the post-confinement period and the approaching summer sales will cause customers to return to stores that have had to close their doors for more than two months. And online commerce will certainly not be outdone, which has experienced a nice upturn during the entire period of confinement. But before you make any purchases that you have had to postpone as a result of the coronavirus crisis, don't forget to take your credit card with you. It is much more useful than you might think.

-

Socially responsible consumption in three questions

Socially responsible consumption is on the rise in Luxembourg. So why don’t you buy fair trade products and become a socially responsible consumer too? Let's answer a few questions about it.

-

Student employees’ rights and obligations

As a student, you might want to make some extra money and gain some paid work experience. Very good idea, but do you know your rights and obligations as a student employee?

-

Survival guide for safe winter driving

Freezing temperatures can transform a simple landscape into a winter wonderland. But for drivers, winter is not always particularly pleasant. Wet roads are hazardous enough, never mind those covered with snow or black ice… Since not everyone can leave their car in the garage, here are some pieces of advice for getting through the winter months without a hitch.

-

The best nine questions to ask before choosing a bank

Choosing a bank is far from simple these days, with so many traditional and online financial providers available. The decision is all the harder to make as a bank tends to be a long-term commitment.

-

The costs of having kids

Have you heard people say: “If you start calculating how much children cost, you would never have them!”? A recent article in the Guardian stated that the cost of raising a child and supporting them through university could add up to over £227,000!

-

The four golden rules to consume better and less

Here are some tips for wasting less and buying more responsibly while controlling your spending.

-

The three ways to buy greener without breaking the bank

Dealing with these significant expenses is not easy, especially in the present time. But how to buy green without breaking into your piggy bank?

-

What €100 can get you in 15 of Europe’s major capital cities (1)

Anyone who has travelled knows that prices can change a lot from one city to the next, even within the same country. With €100 you won’t have the same level of purchasing power in Madrid as you would in, say, London or Bucharest...

-

What formalities to follow at your arrival in Luxembourg

If you have just arrived in Luxembourg or if you intend to come into the country in the near future, one of your first steps will be the opening of a bank account. But which bank to choose?

-

What insurances do I need to take in Luxembourg?

You have just arrived in Luxembourg and you don’t know what insurances are mandatory in the country? You want more information on additional coverage options you might need to protect yourself and your loved ones? Follow the guide!

-

What is 3D Secure payment?

3D Secure is an internationally recognised security standard for online payments. The service is limited in Luxembourg to credit cards.

-

What is a donation?

Unlike the will which takes effect at death, donation is an act by which a person called the donor transfers during his lifetime irrevocably and gratuitously any property to another person called the donee.

-

What is automatic exchange of information?

Automatic exchange of information in the field of taxation is a measure imposed by the European Union to improve tax transparency and cooperation between European tax administrations. In a way, it puts the final nail in the coffin of banking secrecy as practised in the Grand Duchy of Luxembourg over the years. Automatic exchange of information will be implemented in two phases.

-

What is SEPA?

SEPA refers to Single Euro Payments Area and consists of the 28 European Union member states, the 4 members of the EFTA (Iceland, Liechtenstein, Norway and Switzerland), Monaco, San Marino, Vatican city State and Andorra (from 2016).

-

What is the best way to save money when planning a holiday?

Deciding how to spend a well-deserved summer holiday can be exciting. Should you go back to a favourite location, or try something new? But there can be tricky trade-offs, such as whether to decide early and book ahead or wait as long as possible in the hope of finding a better deal.

-

What is the purpose of index-linking?

In Luxembourg, all wages and welfare payments (including the minimum wage) are regularly adjusted to changes in the retail prices of consumer products, in other words to inflation. But what exactly is the purpose of index-linking?

-

What the circular economy is, and how to get the best out of it

The innovative circular economy model currently has the wind in its sails. But what exactly is it, and how can it help you save money?

-

What will the bank of the future look like?

Crowdfunding platforms where everyone can fund a project or seek funding, mobile applications that allow you to manage your banking activities from your smartphone or your computer, digital currencies such as bitcoins, electronic payment systems where you don’t need to enter your code bank: the world of finance has changed considerably in the past decade and it is only the beginning!

-

Why do banknotes coming out of the ATM always look new?

Good question. To answer it, let’s start from the beginning. The European Central Bank is the legal issuer of euro banknotes but the national central banks of the euro area are responsible for maintaining the quality and the good circulation of euro banknotes in their own country.

-

Will artificial intelligence radically alter banking work?

Will the banker of the future be a robot? This is the question more and more observers are asking in the wake of the dazzling progress made by artificial intelligence in the field of finance.